The primary objective of the Bank of Ghana is to pursue sound monetary policies aimed at price stability and creating an enabling environment for sustainable economic growth. Price stability in this context is defined as a medium-term inflation target of 8±2%, for which the economy is expected to grow at its full potential without excessive inflation pressures.

To achieve the objective of price stability, Bank of Ghana had granted operational independence to employ whichever policy tools were deemed appropriate to stabilise inflation around the medium-term target. The Bank of Ghana’s framework for conducting monetary policy is Inflation Targeting (IT), in which the central bank uses the Monetary Policy Rate (MPR) as the primary policy tool to set the monetary policy stance and anchor inflation expectations in the economy.

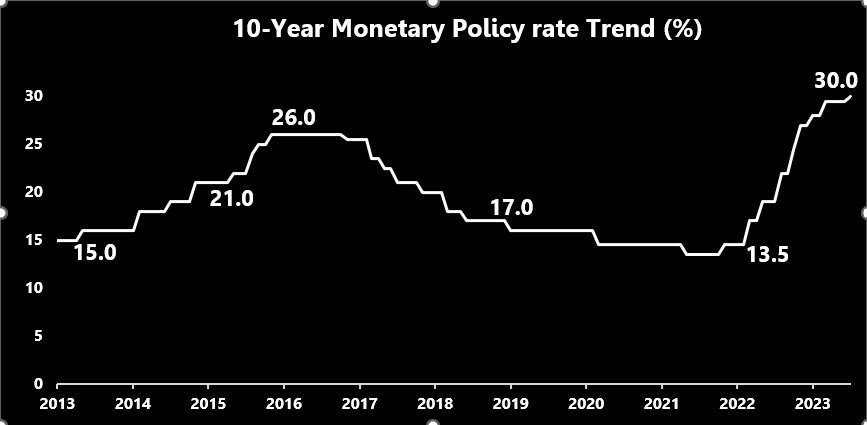

On July 24, 2023, the Monetary Policy Committee (MPC) of the Central Bank announced a 0.5% hike in the Monetary Policy Rate (MPR) to 30.0%. This implied that Ghana’s borrowing rates have now gone up by 16.5 percentage points in less than two (2) years, hitting the highest rate in more than ten (10) years.

The drive to fight Ghana’s inflation by raising interest rates has been going on for over a year and half, resulting in diverse effects on the economy, consumers and investors

Effects on the economy

Ghana’s Real GDP growth slowed to 3.3% in 2022, down from 5.4% in 2021 due to the combined effect of macroeconomic instability, global financial tightening, and the lingering impact of the Russia-Ukraine war. The outlook is skewed to the negative due to possible shocks from a prolongment of the war and a tighter global financial market. The World Bank projects the country’s growth to slow further to 1.6 % in 2023 and remain muted in 2024, before returning toward its potential.

The higher MPR set by the MPC is consequently increasing the cost of borrowing for businesses. With higher borrowing costs, businesses might postpone or reduce their investment plans. Projects that were previously economically viable at lower interest rates might become less attractive, leading to a slowdown in capital expenditure. Startups and small businesses, which often rely on external financing, might find it particularly challenging to secure affordable loans. Thus, it may become a challenge for such businesses to invest in new projects and / or expand their operations. This can contribute to and even further slow down economic growth and hinder job creation.

According to the 2022 Report of the Centre for Affordable Housing Finance in Africa, the average loan amount offered by lenders in Ghana, ranges from GH¢80,000 (US$9,930) to GH¢1,600,000 (US$198,650) for cedi mortgages and US$15,000 (GH¢120,815) to US$35,000 (GH¢281,900) for dollar mortgages. In relation to a mean national household income of GH¢2,828 (US$350) per month and a monthly household expenditure of GH¢1,071 (US$133), the affordability of mortgage and housing in general, remains far-fetched.

Mortgage rates are closely tied to the prevailing interest rates in the economy. As central banks raise the policy rate, commercial banks adjust their lending rates, causing mortgage rates to rise as well. Higher mortgage rates mean that borrowers will have to pay more in interest over the life of their loans. This can lead to increased monthly mortgage payments, making homeownership more expensive. Thus, a potential reduction on the demand for such mortgages. On the flip side, there could be slower home sales and potentially downward pressure on housing prices. Homeowners with adjustable-rate mortgages or existing mortgages with higher rates might find it less appealing to refinance when rates are higher.

The local currency can also be sensitive to policy rate changes. A higher interest rate in a country can attract foreign investors seeking better returns on their investments. As a result, there might be increased demand for the local currency to invest in financial assets, leading to currency appreciation. All things being equal, a higher rate can encourage foreign capital inflows, as investors seek to take advantage of the higher yields available. This influx of foreign funds can drive up demand for the local currency, leading to its appreciation. The increase can makes financial assets, such as government bonds and other fixed-income instruments, more attractive to investors. This yield advantage can lead to increased demand for the local currency.

Bonds

Bond prices and policy rates have an inverse relationship. When rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This leads to a decrease in bond prices. As bond prices decrease, the total return from holding existing bonds could be lower. This can impact fixed-income portfolios, especially for investors holding long-term bonds.

Equities

There can be short-term fluctuations in stock prices with changes in rates as investors consider the likely effects on the profits or revenues of listed companies. A rate hike can lead to higher borrowing costs for consumers, affecting their spending patterns. If consumers cut back on spending due to higher interest rates, companies might experience reduced revenues. High interest rates also result in high financing cost which together with the reduced revenue will lead to lower profits, potentially impacting stock prices.

Real Estate

Real estate developers and homebuyers may face higher borrowing costs due to increased interest rates. This can lead to decreased demand for real estate, affecting property values and potentially impacting real estate investment trusts (REITs) that rely on borrowing.

Fixed Deposits

As interest rates rise due to a rate hike, the interest rates offered on new fixed deposits tend to increase, leading to higher returns for depositors. With higher interest rates on fixed deposits, they can become more attractive compared to other lower-yielding savings vehicles. Savers seeking a secure and predictable return might be more inclined to invest in fixed deposits.

Overall, the monetary policy rate serves as a tool that allows the central bank to influence borrowing costs and, consequently, economic activity and inflation. By adjusting this rate in response to changes in economic conditions, the central bank aims to keep inflation within a target range and ensure stable prices over the medium to long term.

The effectiveness of the monetary policy rate depends on various factors, including the overall economic conditions, the level of interest rates in the economy, fiscal policies, and external economic influences. Central banks use a mix of monetary policy tools and carefully assess economic indicators to determine appropriate adjustments to the policy interest rate in pursuit of their policy objectives.

—————————————————————————————————————————————————————————————-

The information contained in this blog is being provided for educational purposes only and does not constitute a recommendation from any Bora Capital Advisors entity to the recipient. Bora Capital Advisors is not providing any financial, economic, legal, investment, accounting, or tax advice through this blog to its recipient.

This report reflects the views and opinions of Bora Capital Advisors Ltd, and is provided for information purposes only. Although the information provided in the market review and outlook section is, to the best of our knowledge and belief correct, Bora Capital Advisors Ltd, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed in this report, except as required by law. The portfolio performance data represented in this report represents past performance and does not guarantee future performance or results.