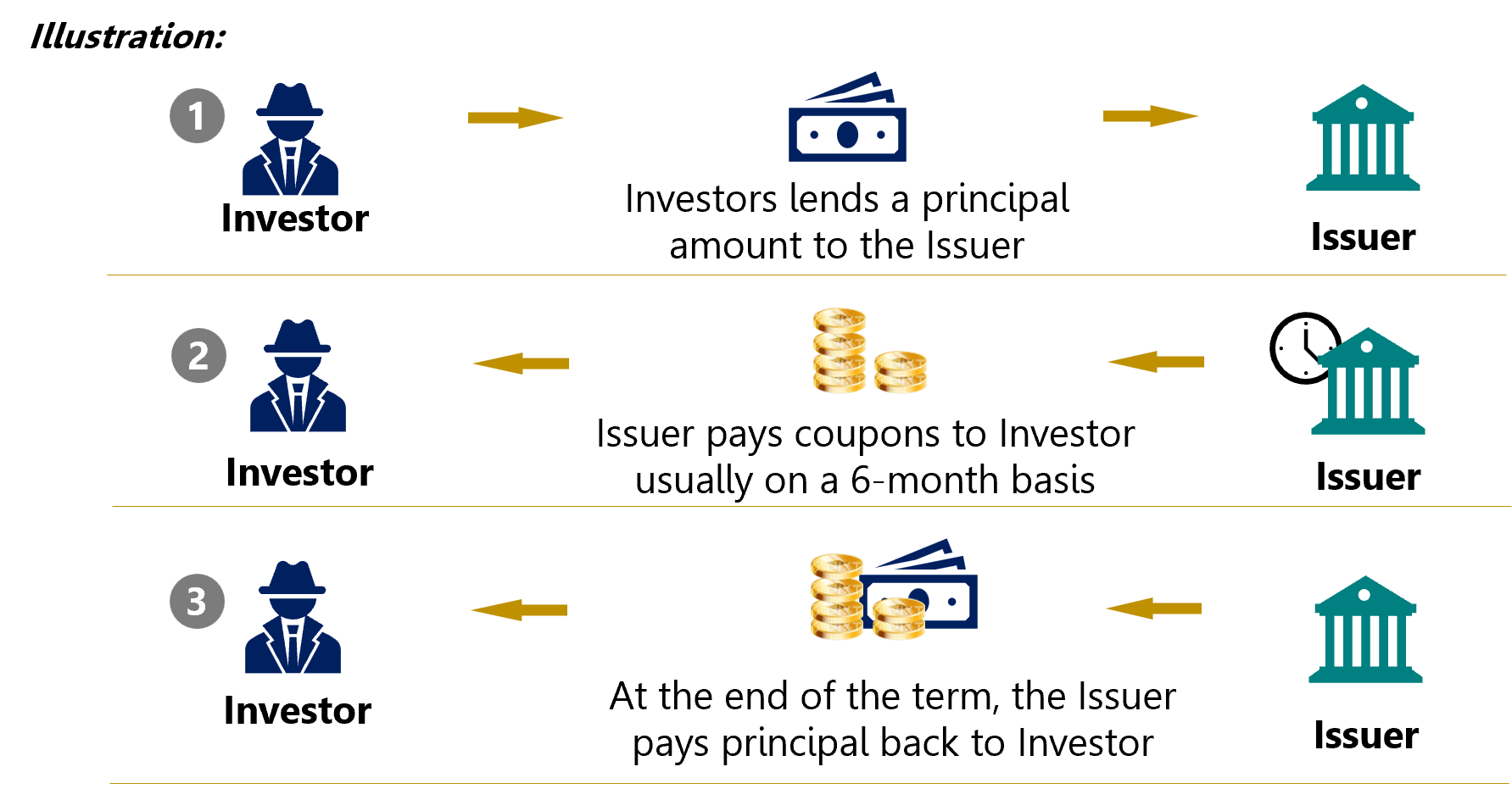

A Bond is a debt security where the issuer issues the bond for purchase by the bondholder (the lender / the investor). It is a fixed income security, as a bond usually gives the investor a regular and fixed interest payment referred to as coupons.

Investing in bonds can be a prudent choice for investors looking for stability, income, and diversification in their portfolios. They are mainly issued by Governments (treasury bonds) and Corporations (corporate bonds) when they want to raise money for projects or refinance existing debts.

By buying a bond, you’re giving the issuer a loan, and they agree to pay you back the face value of the bond on a specified date (maturity date), and pay you coupons, usually twice a year.

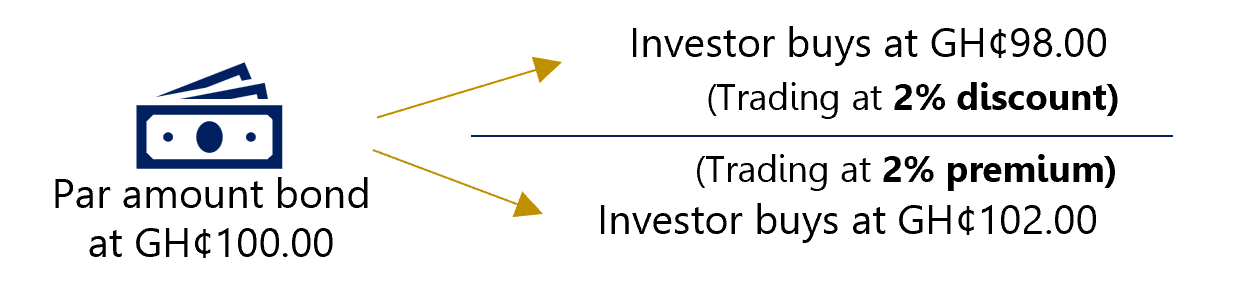

Newly issued bonds normally sell at or close to 100% of the face value (par). If it sells below that amount, it is said to sell at a discount and premium if it sells above par.

Investing in a diversified bond portfolio can help reduce risk. Spreading your investments across different types of bonds, issuers, and maturities can help mitigate the impact of a default or a decline in the value of a particular bond.

Bonds provide a steady stream of income through periodic interest payments. If you reinvest these payments, compounding can enhance your overall returns.

Bonds typically offer lower returns compared to stocks but are generally considered less risky. However, there are differences in risk levels among bonds. Typically, corporate bonds are considered more risky than their treasury equivalents. For treasury securities, the credit rating of the issuing country determines their relative risk, whiles longer dated securities from an issuer carries more risk than shorter dated ones. Corporate bonds with lower credit ratings, usually offer higher yields to compensate investors for the increased risk.

The credit quality of the issuer is an important consideration. Credit rating agencies assign ratings to bonds based on the issuer’s ability to repay its debt obligations. Higher-rated bonds (e.g., AAA or AA) have lower default risk but may offer lower yields. Lower-rated bonds (e.g., BB or B) carry higher default risk but may provide higher yields.

Some Risks associated with investing in bonds

Inflation risk – When inflation increases, bonds can have a negative real rate of return.

Interest rate risk – Interest rates and bond prices are inversely related. If interest rates rise, the price of your bond tend to fall (and vice versa). The longer the time to maturity of a bond, the greater this risk.

Liquidity risk – There is the risk of having to sell a bond at discounted prices due to the lack of a ready market or buyer.

Default risk – Bonds depend on the issuer’s ability to repay the debt, so there is always the possibility of default of payment.

—————————————————————————————————————————————————————————————-

The information contained in this blog is being provided for educational purposes only and does not constitute a recommendation from any Bora Capital Advisors entity to the recipient. Bora Capital Advisors is not providing any financial, economic, legal, investment, accounting, or tax advice through this blog to its recipient.

This report reflects the views and opinions of Bora Capital Advisors Ltd, and is provided for information purposes only. Although the information provided in the market review and outlook section is, to the best of our knowledge and belief correct, Bora Capital Advisors Ltd, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed in this report, except as required by law. The portfolio performance data represented in this report represents past performance and does not guarantee future performance or results.