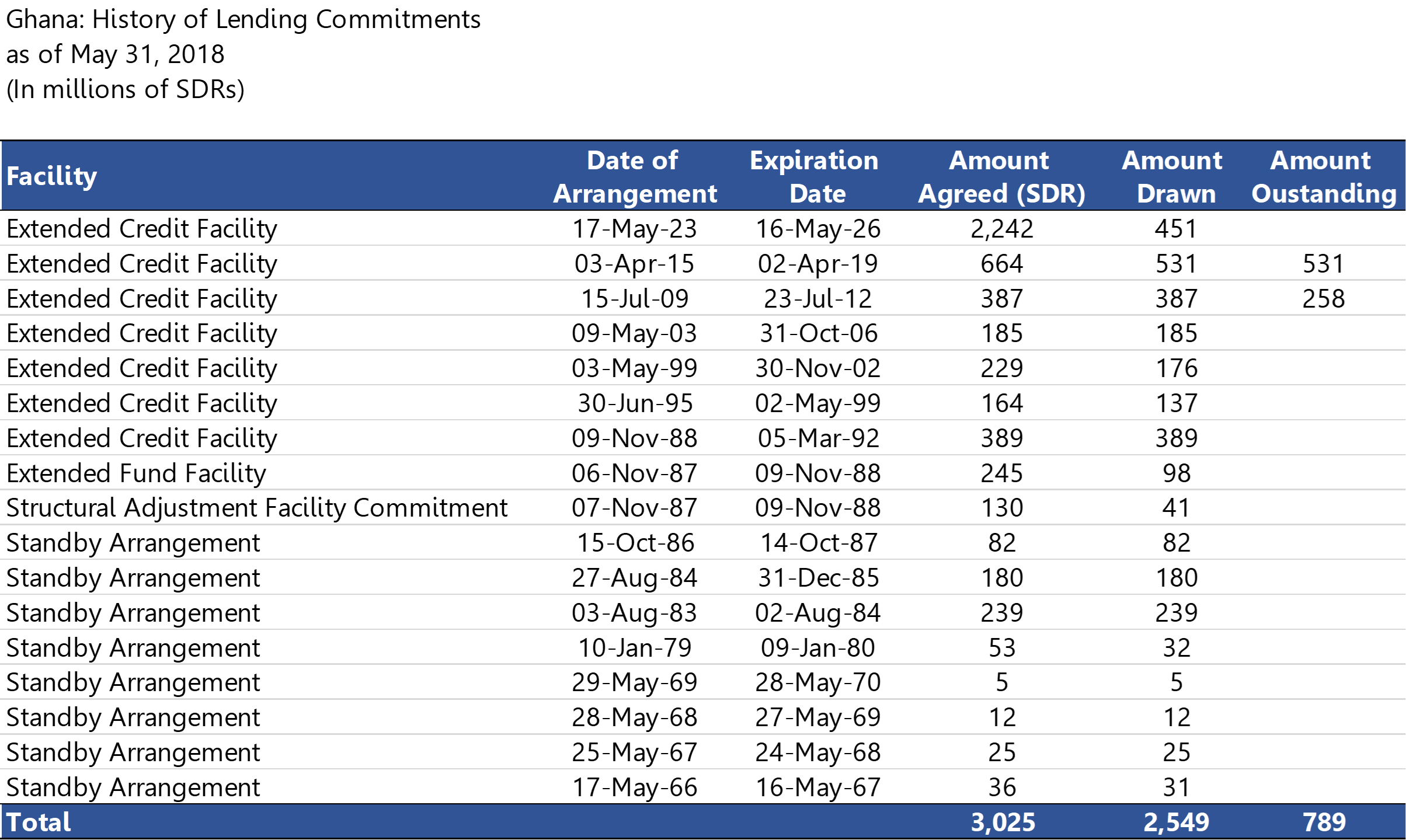

Having reached a staff level Agreement in December 2022, Ghana has finally, secured an International Monetary Fund (IMF) Executive Board approval for a US$3 billion bailout;

An initial disbursement of the first tranche of US$600 million to Ghana’s account was made on May 19, 2023. Subsequent disbursement will be made every six months based on performance review by the IMF;

A few points to note on the potential impact of the bailout are as follows

Cedis vrs. Major Trading Currencies: One key goal of the IMF program is to reach a unified and flexible exchange rate. This has the tendency to restore stability and instill confidence in the economy. Consequently, this may improve market sentiment and reduce speculation against the local currency. Thus, the exchange rate may stabilize or experience less volatility.

Boost of Domestic Economy: The involvement of the IMF in a country’s economic recovery can boost investor confidence. This can attract foreign direct investment, stimulate economic growth, and create employment opportunities for citizens. Increased investment can lead to the development of infrastructure, industries, and businesses, ultimately improving the overall standard of living.

Transparency and Accountability: As part of the bailout program, the IMF recommends the implementation of a public finance management reforms. These reforms, amongst others, allows an integration of all government expenditure into the budget planning and accounting systems. This aims to enhance the efficiency and accountability of government spending, improve budget formulation and execution, and strengthen internal controls and auditing mechanisms. This potentially promotes more transparent and accountable practices, ensuring that public resources are used effectively and for their intended purposes.

Improved Living Standards: The program also aims at fast-tracking the implementation of key growth-oriented programs such as the Ghana CARES (Obaatan Pa) Program. Benefits under the LEAP are being doubled, while the school feeding programme is being adjusted to counteract the effect of the inflation. These are expected to ensure continued access to basic services, particularly for vulnerable populations.

Availability of resources: The program emphasizes fiscal discipline and sound financial management. This has the potential to lead to more efficient use of public resources, reduced budget deficits, and increased fiscal transparency. Ghanaians can benefit from better government budgeting and management, which can help ensure the availability of resources for public services and investments.

However, it’s worth noting that receiving an IMF bailout also comes with potential drawbacks;

Potential Austerity Measures: The conditions attached to the bailout, often involve austerity measures and structural reforms, which can result in short-term economic distress and social hardships;

Impact of Domestic Policies: The bailout can be adversely influenced by the domestic policies and governance, as well as the extent to which the government implements and manages the conditions attached to the bailout;

Government’s ability to implement reforms: The success of these efforts will depend on the government’s ability to implement reforms and manage public finances responsibly.

Source: IMF, Bora Research

—————————————————————————————————————————————————————————————-

The information contained in this blog is being provided for educational purposes only and does not constitute a recommendation from any Bora Capital Advisors entity to the recipient. Bora Capital Advisors is not providing any financial, economic, legal, investment, accounting, or tax advice through this blog to its recipient.

This report reflects the views and opinions of Bora Capital Advisors Ltd, and is provided for information purposes only. Although the information provided in the market review and outlook section is, to the best of our knowledge and belief correct, Bora Capital Advisors Ltd, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed in this report, except as required by law. The portfolio performance data represented in this report represents past performance and does not guarantee future performance or results.