PRIVATE EQUITY & VENTURE CAPITAL: ALTERNATIVE AVENUES FOR WEALTH CREATION

In today’s dynamic investment landscape, diversification remains key to achieving sustainable wealth. While traditional options such as real estate, treasury bills, and mutual funds are widely used, alternative investments like Private Equity (PE) and Venture Capital (VC) are becoming increasingly attractive. These asset classes offer investors the opportunity to participate in the growth and transformation of private businesses — often with the potential for higher long-term returns.

Private Equity

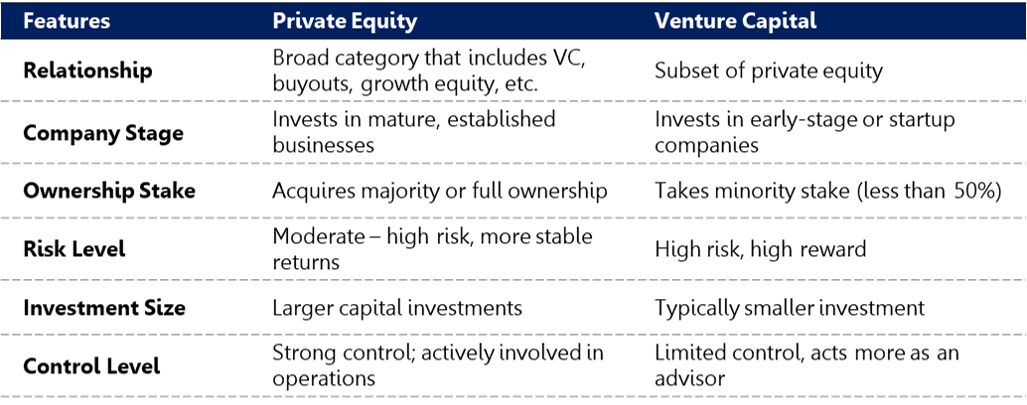

Private Equity (PE) involves investing in established companies that are not listed on a public exchange. PE firms typically acquire significant or controlling stakes in these businesses with the aim of improving operations, driving profitability, and eventually exiting at a higher valuation through a sale or public offering.

Venture Capital

Venture Capital (VC) is a branch of PE that focuses on startups and early-stage companies with strong growth potential but limited track records. VC investors provide funding and guidance to help these businesses scale, often in exchange for equity ownership. Although risk levels are high, successful investments can yield exceptional returns.

Benefits of Private Equity and Venture Capital

1.High Return Potential – Successful PE and VC investments can outperform traditional asset classes

2.Diversification – They provide exposure to markets less correlated with public equities and bonds

3.Access to Innovation – Venture Capital allows investors to participate in emerging technologies and industries

4.Active Value Creation – Investors play a role in improving business strategy, governance, and performance.

Risks Associated with Private Equity and Venture Capital

1.Illiquidity – Investments are locked in for several years with limited early exit opportunities

2.High Risk of Loss – Particularly in VC, where many startups fail to reach profitability

3.Valuation Challenges – Private companies lack transparent market pricing, making it difficult to determine their true value

4.High Entry Requirements – These investments often require significant capital and are limited to accredited investors.

Private Equity and Venture Capital provide investors with a unique opportunity to drive business growth while pursuing higher returns. However, they require patience, risk tolerance, and a long-term mindset. For those looking to diversify beyond traditional investments and explore emerging opportunities, PE and VC can be valuable components of a well-balanced portfolio.

—————————————————————————————————————————————————————————————-

The information contained in this blog is being provided for educational purposes only and does not constitute a recommendation from any Bora Capital Advisors entity to the recipient. Bora Capital Advisors is not providing any financial, economic, legal, investment, accounting, or tax advice through this blog to its recipient. This report reflects the views and opinions of Bora Capital Advisors Ltd, and is provided for information purposes only. Although the information provided in the market review and outlook section is, to the best of our knowledge and belief correct, Bora Capital Advisors Ltd, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed in this report, except as required by law. The portfolio performance data represented in this report represents past performance and does not guarantee future performance or results.