In the evolving landscape of investment, Exchange-Traded Funds (ETFs) have emerged as a powerful tool for investors seeking diversification, cost-efficiency, and flexibility. Over the past few decades, ETFs have transformed the way individuals and institutions approach portfolio management, offering an accessible and innovative means to participate in various markets. This overview delves into the fundamentals of ETFs, exploring their structure, benefits, and the reasons behind their surging popularity among investors worldwide. Whether you’re a seasoned investor or just starting out, understanding ETFs is crucial for making informed decisions and optimizing your investment strategy.

The Structure of ETFs

ETFs are investment funds that trade on stock exchanges, similar to individual stocks or shares. They hold assets such as stocks, commodities, or bonds and many others. ETFs are structured as open-ended funds, meaning they can issue and redeem shares continuously. They are typically designed to track the performance of a specific index such as the S&P 500, particular sector, commodity, or asset class, while others have specific investment strategies. They are created such that investors exchange baskets of underlying assets for ETF shares.

As ETFs trade on stock exchanges, you can buy and sell them throughout any trading day at prevailing market prices. This allows investors to obtain greater flexibility and real-time trading opportunities.

One of the main advantages of ETFs is their ability to provide instant diversification. By investing in an ETF, investors gain exposure to a broad range of assets within a single security. By spreading investments across various assets, sectors, regions, and asset classes, ETFs help mitigate risk and enhance the potential for stable returns.

ETFs offer a cost-effective way to achieve diversification. Buying individual stocks or bonds to replicate the holdings of an ETF can be expensive due to transaction costs and management fees. ETFs provide instant diversification at a lower cost due to their typically low expense ratios and trading fees. They generally have lower expense ratios compared to mutual funds. They are passively managed, meaning they track an index rather than relying on active management, which reduces management fees.

Types of ETFs

Below are a few of the most popular types or forms of ETFs:

Stock ETFs: Track an index of stocks.

Bond ETFs: Invest in government, corporate, or municipal bonds.

Commodity ETFs: Track the price of a commodity, like gold or oil.

Sector and Industry ETFs: Focus on specific sectors or industries, such as technology or healthcare.

International ETFs: Invest in stocks or bonds from specific countries or regions.

Inverse and Leveraged ETFs: Designed to deliver multiples of the performance of the index they track or to perform inversely to the index.

The surging popularity among investors worldwide

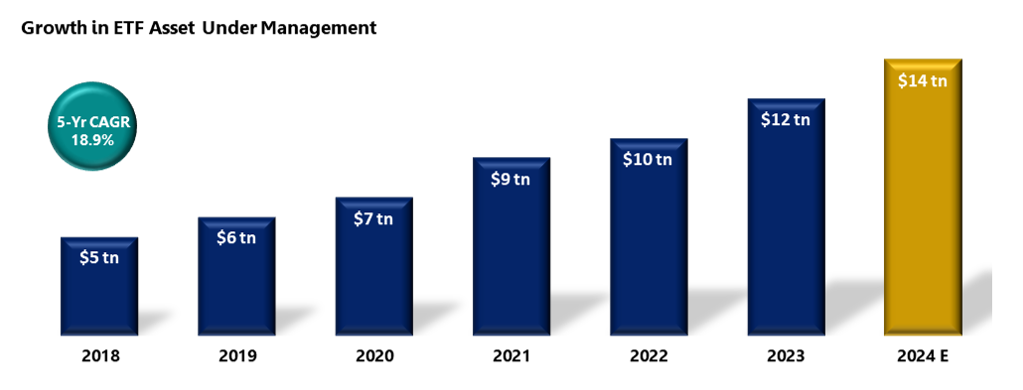

An analysis carried out by PwC, suggests that the assets under management (AUM) of global Exchange-Traded Funds (ETFs) have experienced an impressive Compound Annual Growth Rate (CAGR) of 18.9% over the past five years. From December 2022 to the end of 2023, AUM grew by over 25%, reaching a new record of nearly US$11.5 trillion. Additionally, PwC reports that the number of asset managers offering ETFs has more than doubled since 2013, rising from 233 to 582 over that period, with 60% of the top 100 asset managers now offering ETFs. This underscores the significant opportunities asset managers have identified in the ETF market over the past decade, with no signs of this trend slowing down, according to PwC’s survey results.

The ETF market continues to evolve, offering innovative products that cater to diverse investment needs. From leveraged and inverse ETFs to actively managed ETFs, the variety available allows investors to tailor their portfolios to specific strategies and market conditions.

The flexibility of being able to buy and sell ETF shares throughout the trading day at market makes them particularly attractive compared to mutual funds, which can only be traded at the end of the trading day.

Further, most ETFs disclose their holdings on a daily basis, allowing investors to see exactly what assets they are invested in. This level of transparency helps investors make informed decisions and understand the underlying risks.

Risks of Investing in Exchange-Traded Funds (ETFs)

While ETFs offer many advantages such as diversification, cost-efficiency, and liquidity, they also come with certain risks. Understanding these risks is crucial for making informed investment decisions. Here are some risks associated with investing in ETFs:

- Market Risk

This refers to the potential for an entire market or market segment to decline in value. Since ETFs often track broad indices or sectors, their value can be affected by overall market movements. If the market or sector declines, the value of the ETF will also decline. Also, since ETFs trade like stocks, their prices can be volatile and influenced by market conditions.

- Tracking Error

Tracking error occurs when an ETF does not perfectly replicate the performance of its underlying index. This can happen due to several factors, including management fees and trading costs. High tracking error can lead to returns that differ from those of the target index, affecting the investor’s expected performance.

- Liquidity Risk

While many ETFs are highly liquid, some may have low trading volumes, making it harder to buy or sell shares without affecting the market price. This is especially those that invest in less liquid markets or specific sectors. This can make it harder to buy or sell shares without impacting the market price.

- Currency Risk

For ETFs that invest in international markets, currency risk is a consideration. Changes in exchange rates can impact the value of the ETF’s underlying holdings. If the local currency of the investments weakens against the investor’s home currency, the returns can be negatively affected even if the underlying assets perform well.

Investing in ETFs

Investing in ETFs involves a few key steps to align with your financial goals.

1. First, define your investment objectives, whether they are long-term growth, income, or diversification.

2. Conduct thorough research to select ETFs that match your goals, considering factors like underlying assets, performance history, expense ratios, liquidity, fund size, and tracking error.

3. Next, open and fund a brokerage account, choosing the right type for your needs (e.g., individual, retirement). Once your account is set up, place an order to buy ETFs using market, limit, or stop orders. You could also talk to your fund manager to assist you in such transactions.

After purchasing ETFs, regularly monitor your investments to ensure they continue to align with your goals. Rebalance your portfolio periodically to maintain your desired asset allocation, and be mindful of the tax implications of your ETF transactions.

ETFs represent a versatile and accessible investment option that combines the benefits of diversification, cost-efficiency, and liquidity. They allow investors to easily gain exposure to a wide range of assets, sectors, and geographic regions through a single investment vehicle. With low expense ratios and the ability to trade throughout the day on stock exchanges, ETFs offer flexibility and transparency. Whether you’re seeking long-term growth, income generation, or risk mitigation, ETFs provide a practical solution that can be tailored to fit different investment strategies and goals. By understanding the risks, monitoring performance, and maintaining a diversified

Source: ETFdatabase