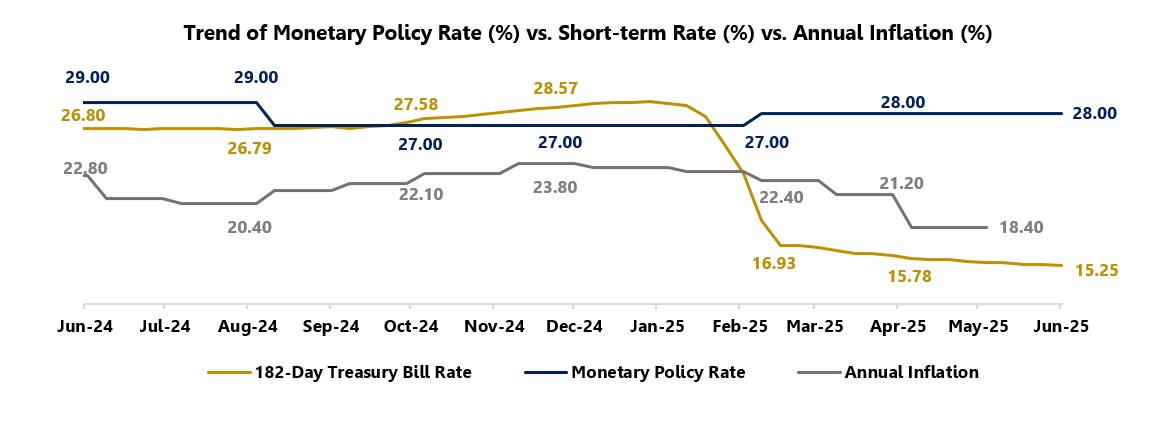

On March 31, 2025, the Bank of Ghana (BoG) made a surprising move: it increased the Monetary Policy Rate (MPR) from 27% to 28%. This decision was meant to “re-anchor the disinflationary process,” even though inflation had been falling, making most market watchers to expect the central bank to hold or even cut rates. At the most recent 124th Monetary Policy Committee (MPC) meetings held from 21 to 23 May 2025, the Committee, by a unanimous decision, maintained the Monetary Policy Rate (MPR) at 28%, amidst falling inflation as well as falling interest rates on the short-term bill. Another surprising move.

Typically, a hike in the MPR leads to a rise in interest rates across board, especially for government securities like Treasury bills (T-bills). But that hasn’t happened. Instead, T-bill rates have continued to slide, week after week, indicating a disconnect between the MPR hike and the rates.

This apparent disconnect is a reminder that the relationship between the MPR and market rates isn’t always straightforward. A range of economic and psychological factors can influence outcomes—sometimes in ways that override the textbook expectations. For instance;

1. Investor Sentiment and Expectations

Markets are forward-looking. Many investors see the MPR hike as temporary, especially in light of steady progress in reducing inflation. They may be anticipating rate cuts in the near future, which would make locking in current T-bill yields attractive—even if those yields are falling.

1. Real Returns Look Promising

With inflation declining, the real (inflation-adjusted) return on T-bills is improving. This makes T-bills appealing even at lower nominal rates, encouraging more demand and pushing yields down further.

3. Support from the IMF and Ongoing Reforms

Confidence is growing due to Ghana’s ongoing debt restructuring efforts and support from the International Monetary Fund. These developments have reduced perceived risks in the economy, making investors more comfortable with accepting lower returns on government debt.

4. Currency Dynamics

Interestingly, the recent strengthening of the cedi against major currencies like the US Dollar, may have contributed to stronger demand for local currency instruments. With currency risks seen as manageable or even declining, investors are more willing to hold domestic debt.

5. Government Fiscal Discipline

The government has also introduced spending cuts and measures to control public finances. This has reduced the need for excessive borrowing and delayed the pace of public spending—another factor putting downward pressure on interest rates.

In Summary:

The BoG’s MPR hike may have grabbed headlines, but the broader story is more complex. Market dynamics, expectations, and structural reforms are shaping the current interest rate environment. Whether falling T-bill rates are sustainable remains to be seen—but for now, the Ghanaian treasury bill market is telling a different story than the policy rate might suggest.

—————————————————————————————————————————————————————————————-

The information contained in this blog is being provided for educational purposes only and does not constitute a recommendation from any Bora Capital Advisors entity to the recipient. Bora Capital Advisors is not providing any financial, economic, legal, investment, accounting, or tax advice through this blog to its recipient. This report reflects the views and opinions of Bora Capital Advisors Ltd, and is provided for information purposes only. Although the information provided in the market review and outlook section is, to the best of our knowledge and belief correct, Bora Capital Advisors Ltd, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed in this report, except as required by law. The portfolio performance data represented in this report represents past performance and does not guarantee future performance or results.