The Government of the Republic of Ghana announced on July 31, 2023 that it was inviting Pension Funds holding domestic notes and bonds of the central Government, E.S.L.A. Plc and Daakye Trust Plc to exchange approximately GH¢31 billion principal amount of Eligible Bonds for a package of new bonds.

Holders of the eligible bonds who validly tender their holdings would receive in exchange for their Eligible Bonds, the same aggregate principal amount distributed across new tranches of the Government’s outstanding Bonds that were issued in February 2023 and maturing in 2027 and 2028 as part of the Domestic Debt Exchange Program (DDEP).

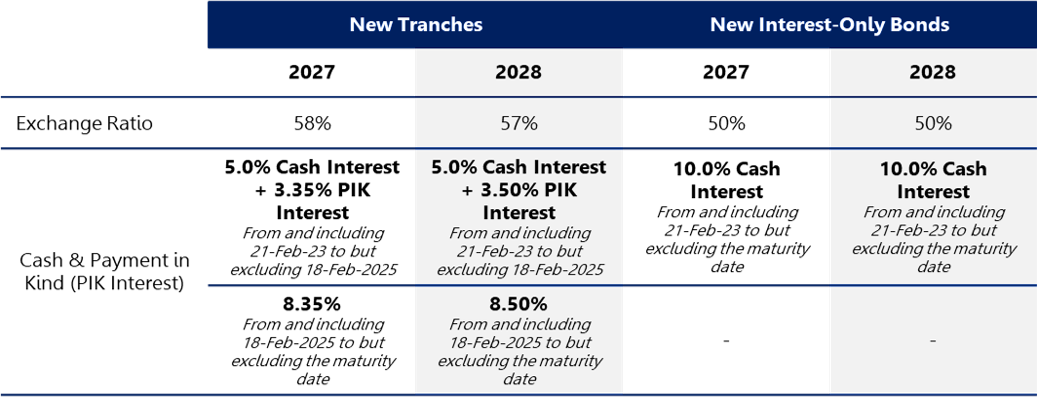

The new bonds will have an average coupon of 8.4%, in addition to a 15% increase in the principal value. Further, there will be two additional cash payment instruments with a 10% coupon (“New Interest-Only Bond”).

Table 1 below indicates the details of the exchange.

At the end of the offer period, Pension funds agreed to exchange GH¢29 billion out of the existing GH¢31billion bonds for the new notes maturing in 2027 and 2028, representing about 94% exchange success rate.

The Implications for Pension Funds and Pension Pay-outs

Excessive Exposure to a Single Issuer

Prior to the DDEP, most pension funds had about 75% exposure to the Government of Ghana (GoG). However, post DDEP and conversion of ESLA and Daakye bonds to GoG bonds, most pension funds exposure to the GoG is around 80 – 90%. Thus, the need to find alternative investment instruments. The DDEP has however taken off ESLA and Daakye bonds which served as alternative instruments, thus, narrowing the broad stream of qualifying issuer choices by pension funds.

By pension funds having a significant portion of their portfolio in GoG securities, there is also the likelihood on missing out on potential higher returns from other investment opportunities with higher risk and return potential.

Higher Risk to Potential Default in 2027 and 2028

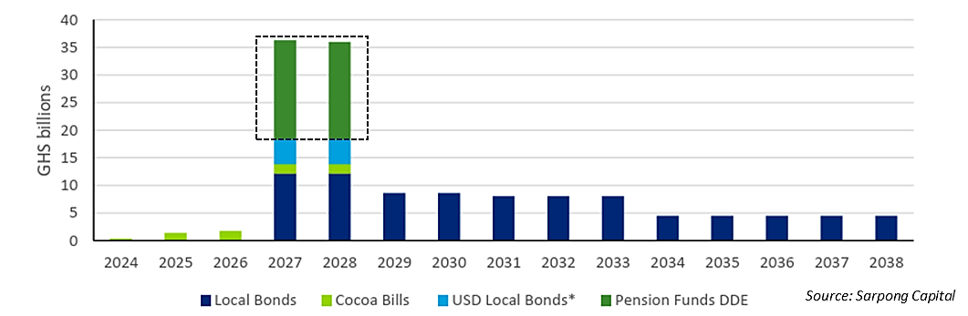

Whiles the maturity profile of the Universal Banks, per their restructured bond terms cover 2027 to 2038, pension funds, who have the capacity for long term investment have maturities spread over only two (2) years, 2027 and 2028. Should the Government default, these funds will be badly hit as they carry the highest potential default at the moment.

Figure 1 – Maturity Wall of Restructured Domestic Bonds Present Concerns for 2027 and 2028

Liquidity

The pension funds which usually hold long-term bonds have had the maturity dates of all bonds moved to 2027 and 2028 (4 to 5 years). Shortening the maturity dates means that the bonds will mature sooner than originally anticipated. This could lead to an influx of principal repayment into the pension fund’s portfolio. While this might increase the fund’s liquidity in the short term, it could also pose challenges in reinvesting those funds to maintain a steady income stream, especially if suitable investment opportunities with similar risk and yield profiles are limited.

However, in the short-term, the market uncertainty created by the domestic debt exchange has led to a loss of confidence that is affecting the tradability of Government bonds. Investors may shift their preferences towards other types of investments or assets, such as equities or alternative fixed-income securities. This shift in preference can further reduce the tradability of the bonds.

For schemes that focus on coupons, they might have their income and liquidity disrupted. This is because the payment dates have all been bulked up into two (2) specific dates in each year, i.e. February and August of each year until maturity. There is thus infrequent coupon payments, disrupting the income and planned payments on debt obligations.

Increased Income

In the short-term, interest is reduced, but the 15% increase in the principal value provides increased income upon maturity. Thus, even though in the short term the pension funds will receive less income from coupons, there is the possibility of gaining more than anticipated income in the long term if the increased face value received at maturity is reinvested at a better market rate. This is however dependent on the prevailing interest rates upon maturity which can consequently increase the overall income or returns compared to what would have been under the original bond structure.

A pension fund with a stronger financial position is better equipped to navigate market fluctuations and economic challenges. This can lead to overall portfolio growth and help the pension fund achieve its long-term investment objectives.

—————————————————————————————————————————————————————————————-

The information contained in this blog is being provided for educational purposes only and does not constitute a recommendation from any Bora Capital Advisors entity to the recipient. Bora Capital Advisors is not providing any financial, economic, legal, investment, accounting, or tax advice through this blog to its recipient.

This report reflects the views and opinions of Bora Capital Advisors Ltd, and is provided for information purposes only. Although the information provided in the market review and outlook section is, to the best of our knowledge and belief correct, Bora Capital Advisors Ltd, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed in this report, except as required by law. The portfolio performance data represented in this report represents past performance and does not guarantee future performance or results.