An investment strategy is not complete without a risk management plan which is very crucial whether you are investing in a stable, declining or a recovering market environment.

A risk management plan should keep your losses at levels that are acceptable whiles ensuring that you are able to meet short term emergencies that may arise during the investment period. One effective strategy to adopt is DIVERSIFICATION.

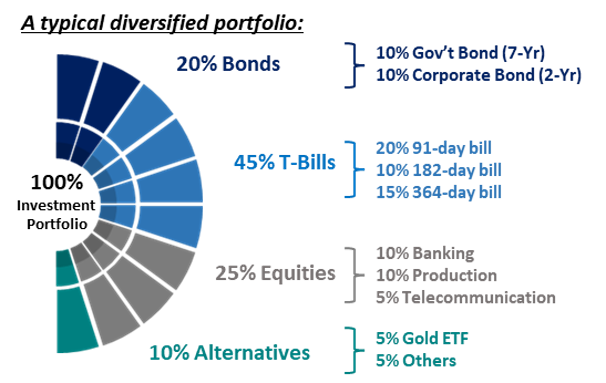

Investment diversification is a strategy used to manage risk by spreading your investments across various asset classes and assets. Its purpose is to reduce the potential impact of poor performance in any single investment on your entire portfolio. By diversifying, you aim to minimize the risk associated with putting all your investment resources in one place. This occurs as you apportion your investments in a manner that ensures that an adverse event impacting one asset will be offset by the good performance of other assets. Different assets and asset classes will also be affected differently by general economic trends thereby minimizing overall impact.

Here are a few key points to consider when it comes to investment diversification:

Different Asset Classes

Diversification involves investing in different types of assets such as stocks, bonds, real estate, commodities, cash equivalents, etc. Each asset class carries its own risk and return characteristics. By investing across various asset classes, poor performance in one asset class may not necessarily result in the poor performance of the entire portfolio. Allocating investments to various asset types can reduce losses, i.e. if one loses value because of fluctuating prices, the others could remain unaffected or may even gain value.

Different Industries / sectors

Within each asset class, diversifying across different sectors can help mitigate risk. For instance, within the stock market, you might invest in companies from various sectors like technology, healthcare, finance, consumer goods, and energy. Thus, if you happen to buy shares, select ones in industries that are not directly related, e.g. banking, technology, and manufacturing. This way, if one sector performs poorly, the others may offset the losses.

Different Maturity Lengths

While diversifying, maturity lengths help to reduce risk. Investors must consider their own liquidity needs and expectations. Instead of investing in an instrument or instruments with similar maturity profiles, you can create a portfolio of assets with staggered maturities. For example, you might invest in bonds with one-year, three-year, five-year, and ten-year maturities. This strategy allows you to have a continuous stream of maturing bonds, providing flexibility to reinvest or access funds as needed.

Different Geographical locations

It is a good practice to find investment alternatives in other countries that have a positive economic outlook. Economic conditions and market cycles can vary across regions. By investing in different countries, you can reduce the impact of a downturn in any one country on your portfolio.

Risk Tolerance

Consider your risk tolerance and investment goals when diversifying your portfolio. Conservative investors may lean towards a higher allocation of bonds or cash equivalents, while more aggressive investors may have a higher allocation of stocks or alternative investments.

Some Risks associated with diversifying

It is however necessary to note that while diversification is generally considered a risk management strategy, it is important to understand that it does not completely eliminate risk.

Further, too many diversified assets in a portfolio can lead to higher management costs.

Diversifying into unfamiliar asset classes or investments without proper knowledge and research can increase the risk. It is important to understand the characteristics, risks, and dynamics of each investment before including them in your portfolio.

The Way Out

To mitigate these risks, it is crucial to regularly review and monitor your portfolio, stay informed about market conditions, and maintain a balanced approach to diversification. Regularly assess your portfolio and make adjustments as necessary to maintain a diversified allocation. Changes in market conditions, economic factors, or your own financial situation may necessitate adjustments to your diversification strategy.

It is also advisable to seek professional financial advice to ensure your diversification strategy aligns with your investment goals, risk tolerance, and time horizon.

—————————————————————————————————————————————————————————————-

The information contained in this blog is being provided for educational purposes only and does not constitute a recommendation from any Bora Capital Advisors entity to the recipient. Bora Capital Advisors is not providing any financial, economic, legal, investment, accounting, or tax advice through this blog to its recipient.

This report reflects the views and opinions of Bora Capital Advisors Ltd, and is provided for information purposes only. Although the information provided in the market review and outlook section is, to the best of our knowledge and belief correct, Bora Capital Advisors Ltd, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed in this report, except as required by law. The portfolio performance data represented in this report represents past performance and does not guarantee future performance or results.