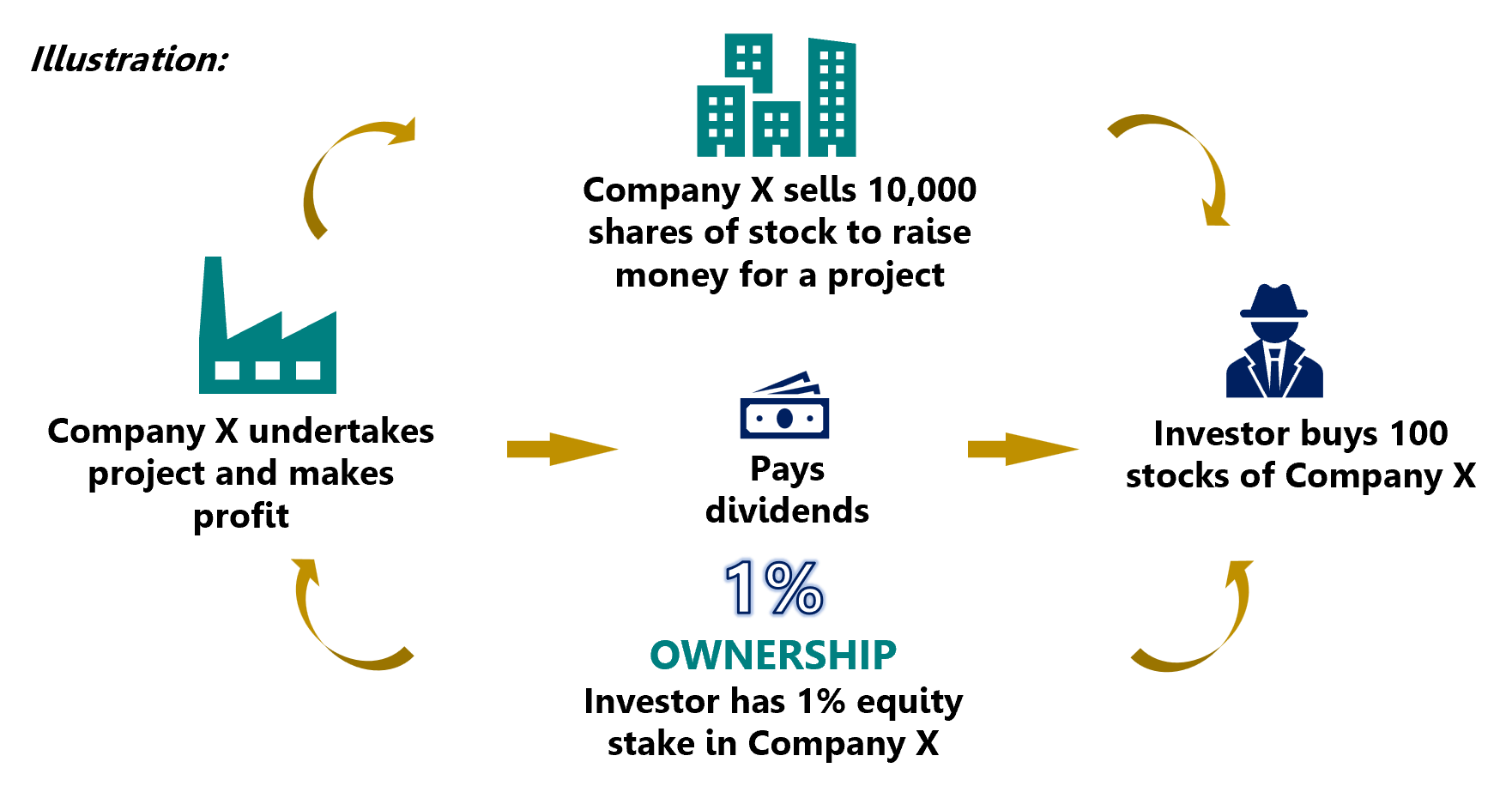

Equities, also known as stocks or shares, represent ownership stakes in a company. Stocks are issued by companies when they decide to raise capital by selling ownership in the company to investors.

In exchange for buying these shares, investors become partial owners of the company and are entitled to a number of rights, key amongst which is a proportional share in the company’s distributed profits, known as dividends.

Equities are often seen as a long-term investment, as the stock market tends to experience volatility in the short-term but has historically shown overall growth over longer periods of time. However, like any investment, there are risks associated with investing in equities and investors should carefully consider their goals and risk tolerance before making any investment decisions.

Before you buy those shares

Assess the broader industry trends for potential growth, competition, and any regulatory changes that may impact the industry. Some industries are more sensitive to economic cycles, meaning their performance is closely tied to economic conditions. During economic downturns, these industries may experience declines in revenue and profitability. Further, industries that are heavily regulated face the risk of changes in government regulations, compliance requirements, and legal challenges. New regulations or legal issues can impact a company’s operations, profitability, and stock performance.

Review Company financials to gain insights into the company’s revenue, profitability, debt levels, etc. Look at the company’s financial trends over the past few years. Assess if the company has been able to consistently grow its revenue or if there are any significant fluctuations. Consider the factors driving the company’s growth or decline. This can help you make an informed decision about whether the company is a good investment opportunity or not.

Evaluate Company leadership to ascertain whether the management has the expertise and track record to drive growth and navigate challenges. Look for transparent and effective corporate governance practices as well as their strategic vision. Evaluate their ability to adapt to changing market conditions and look for indications that the management team has a clear plan and is capable of executing it effectively. It is crucial to determine if members of the management team have a significant ownership stake in the company. This can align their interests with shareholders and indicate a commitment to the company’s success.

Value the business by comparing the company’s current stock price to its earnings, revenue, and other key metrics to determine if it is overvalued or undervalued. This involves assessing the worth of the business based on various factors, such as its financial performance, future growth prospects, industry dynamics, and comparable company analysis. The goal is to determine whether the current market price of the company’s stock represents a good investment opportunity.

Know your risk tolerance. Stocks can be volatile. Be prepared for potential stock price fluctuations. That is, understand your personal ability and willingness to accept the potential risks and fluctuations associated with investing in stocks. It involves assessing your comfort level with uncertainty, potential losses, and market volatility.

Some Risks associated with investing in equities;

Market Volatility: Stock markets can be volatile, with prices fluctuating frequently. Market volatility can be influenced by economic conditions, geopolitical events, investor sentiment, and other factors. These fluctuations can lead to gains or losses in the value of stocks.

Company-specific risk: Investing in individual stocks exposes you to company-specific risks. Factors such as competition, management, financial health, and legal issues can all impact a company’s performance and, in turn, its stock price.

Liquidity risk: Certain equities may have lower trading volumes, making it difficult to buy or sell them at desired prices. Illiquid stocks can result in wider bid-ask spreads and may take longer to execute trades. This can pose challenges when trying to enter or exit positions. Stocks that are not actively traded may be difficult to sell quickly.

Systematic Risk: Systematic risk refers to risks that affect the entire market. Factors like economic recessions, interest rate changes, political instability, or natural disasters can impact the stock market as a whole, potentially causing prices to decline across different stocks.

—————————————————————————————————————————————————————————————-

The information contained in this blog is being provided for educational purposes only and does not constitute a recommendation from any Bora Capital Advisors entity to the recipient. Bora Capital Advisors is not providing any financial, economic, legal, investment, accounting, or tax advice through this blog to its recipient.

This report reflects the views and opinions of Bora Capital Advisors Ltd, and is provided for information purposes only. Although the information provided in the market review and outlook section is, to the best of our knowledge and belief correct, Bora Capital Advisors Ltd, its directors, employees and related parties accept no liability or responsibility for any loss, damage, claim or expense suffered or incurred by any party as a result of reliance on the information provided and opinions expressed in this report, except as required by law. The portfolio performance data represented in this report represents past performance and does not guarantee future performance or results.